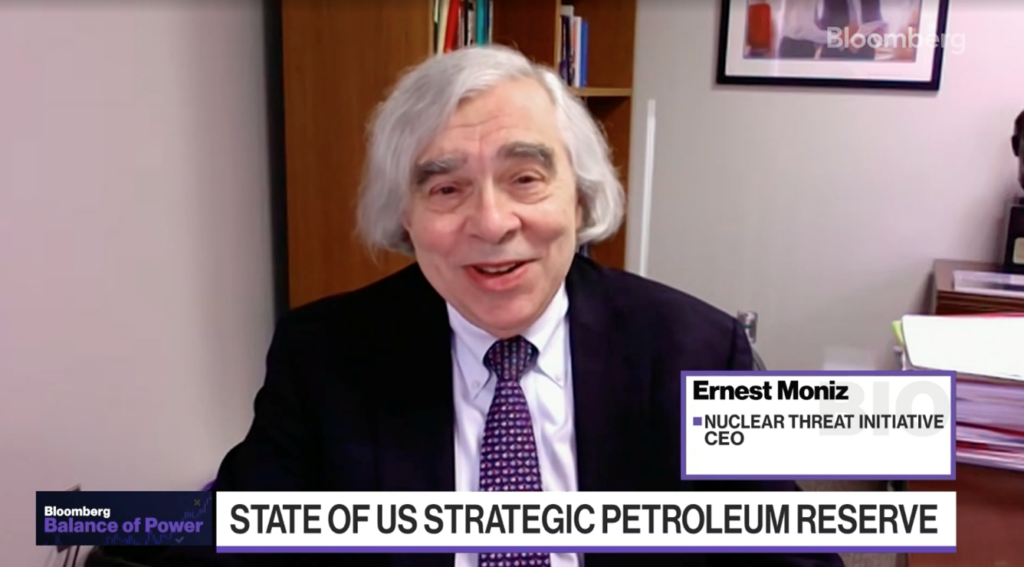

Energy Futures Initiative (EFI) CEO Ernest Moniz spoke with Joe Mathieu and Kailey Leinz on Bloomberg’s “Balance of Power” on April 10, 2023. He discussed the status of the Strategic Petroleum Reserve (SPR) and its relevance to U.S. energy security.

The decline in oil prices a few weeks ago—to below $70/barrel—raises questions about the state of the SPR, the world’s largest supply of emergency crude oil. The SPR was established primarily to reduce the impact of disruptions in supplies of petroleum products and to fulfill U.S. obligations under the international energy program.

During the interview, Mathieu asked Moniz whether the price dip was a missed opportunity to replenish the SPR, following the Biden administration’s decision to gradually release oil from it in 2022. Moniz underscored that the crude oil price only dropped briefly, highlighting a more lasting issue with the SPR dating back to his tenure as U.S. energy secretary from 2013 to 2017.

“The bigger problem… is the Congress did not put enough emphasis on energy security issues at that time,” Moniz explained. “They started to use the petroleum reserve, frankly as a piggy bank, to address other issues, important issues, but not connected to energy and security.”

Moniz said that while oil prices could fall again in the future, uncertainty in the global economy makes it difficult to predict.

“It’s really going to depend, I think very much, on the great uncertainty in demand,” Moniz said. “China may start growing again, increasing demand, but the West may go into recession, which would obviously suppress demand. I think we just don’t know.”

Moniz warned, however, that the SPR is depleted and should be refilled if prices fall.

“If we had another major [energy] issue to deal with, we would be severely compromised with the current size of the petroleum reserve,” Moniz said.

— Meredith Lu, Communications Intern

(Share this post with others.)