Energy Futures Finance Forum — Increasing the quality of investments for deep decarbonization.

Successfully achieving the global clean energy transition requires more than just technological progress – massive financing and investment are needed to deploy decarbonization assets at scale.

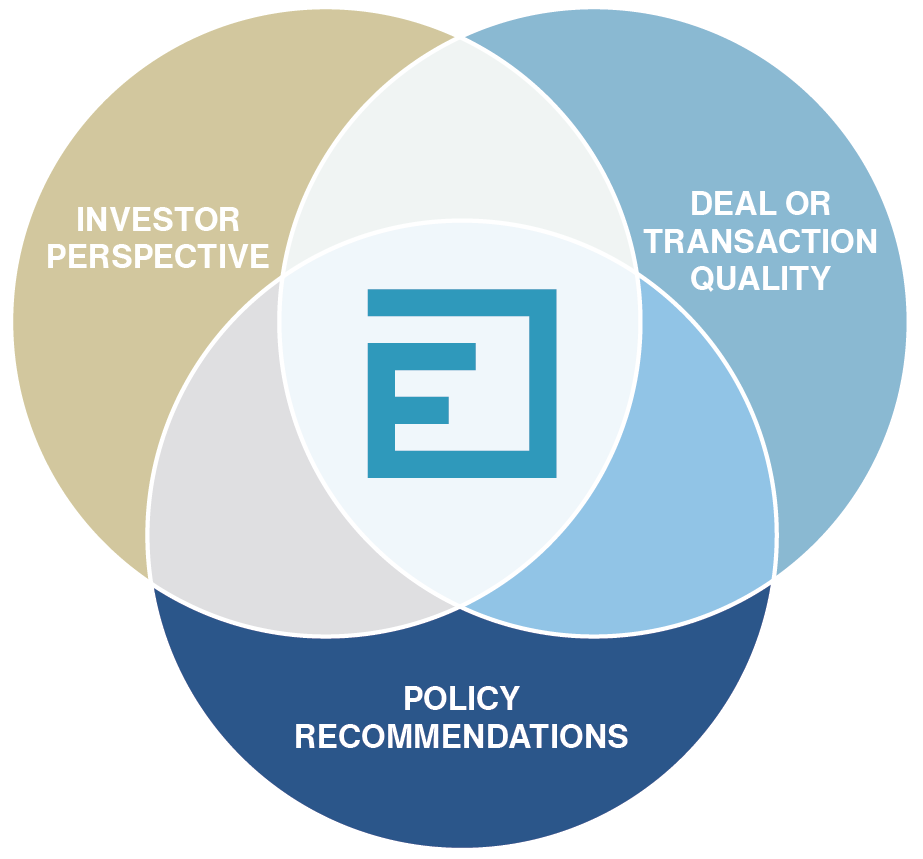

The Energy Futures Finance Forum (EF3) offers policy recommendations reflecting an investor’s perspective that decarbonization investments must be a blue chip.

Recent Work From EF3

Energy Futures Finance Forum Mission

EF3 analyzes the policy and regulatory barriers to large, private capital flows to decarbonization opportunities and provides actionable recommendations in response.

EF3 offers policy recommendations reflecting an investor’s perspective that decarbonization investments must be blue chip.

EF3 will provide rigorous, unbiased analysis and thought leadership, coupled with broad and continuous stakeholder engagement, to form policy recommendations at the intersection of finance and clean energy to drive deployment and diffusion of essential technologies. Through its research and engagement activities, EF3 will help facilitate international, national, and industrywide efforts to scale up investments to decarbonize the economy.

Watch the EF3 launch event to better understand our mission.

Meet the EF³ Leadership

Stephen D. Comello

Senior Vice President, Strategic Initiatives

Executive Director, Nuclear Scaling Initiative

Managing Director, Energy Futures Finance Forum

Meet the EF³ Advisory Board

Supporters

The Energy Futures Finance Forum is grateful to JPMorgan Chase & Co. for its generous founding grant.